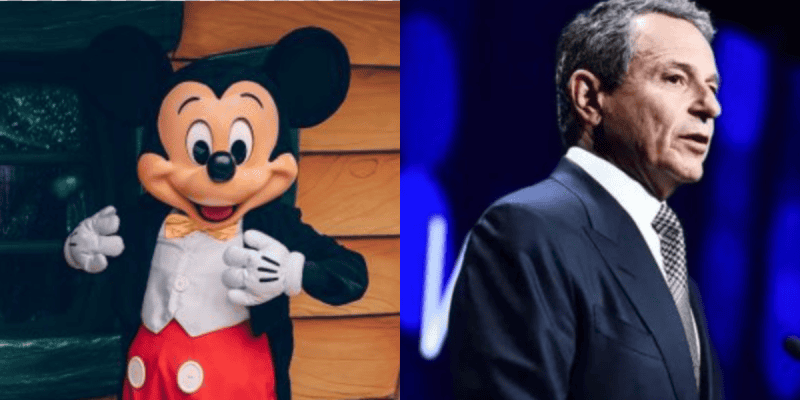

Bob Iger has always had a knack for delivering a confident soundbite.

Whether he’s on stage at an investor meeting, chatting with reporters, or fielding tough questions from shareholders, the Disney CEO knows how to project optimism. Since his return to the top job, he’s been selling a vision of Disney’s future that blends creative resurgence, streaming, sports expansion, and a calmer cultural presence.

The problem? A lot of what he’s promising requires Disney to move faster and more flawlessly than the current realities of the business may allow.

The studio’s theatrical slate is still trying to recover from a run of underwhelming releases, streaming competition is fiercer than ever, sports rights are only getting more expensive, and even Disney’s most loyal parkgoers have grown sensitive to rising prices. That’s not even including the cultural blunders the company has made.

It’s not that Iger’s vision is impossible—it’s that he’s talking about big wins that will take years of execution to pull off, all while markets, fan expectations, and competition keep shifting under his feet. Let’s look at some of the boldest quotes he’s made recently, and why they might be harder to cash in than they sound.

“Our priority is to put out great movies…”

In an August earnings call, Iger doubled down on the idea that Disney will focus on quality over quantity, promising “great movies that ultimately resonate with consumers.” He’s pushed this narrative since his return—acknowledging that Disney’s previous content flood may have hurt quality, while pledging to rein things in.

The challenge? Many of Disney’s upcoming projects are still sequels, remakes, or reimaginings. While some, like Inside Out 2, have connected with audiences, others have failed to meet expectations. It’s a delicate balancing act: delivering fewer, better films while sticking to the same franchise-heavy strategy that arguably caused the problem in the first place.

“Demand is extremely high” (even as prices rise)

On the parks side, Iger has continued to claim that demand remains “extremely high,” pointing to expanded capacity and new attractions as proof that Disney vacations remain a strong value compared to other entertainment.

While parks continue to draw huge crowds, there’s no ignoring the price increases and the way they’ve changed the conversation among fans. For many, it’s not about whether Disney is worth it—it’s whether they can still justify the cost year after year.

“For $29.99 you can get Disney+, Hulu and ESPN…”

Iger has also been touting the company’s new streaming bundle, pitching it as “an incredible bargain” that will keep subscribers engaged across all three platforms. On paper, the value is obvious—Disney+, Hulu, and ESPN together for less than the cost of many standalone services.

But pulling it off profitably is another story. Bundling lowers the perceived cost, but it also raises the expense of what Disney has to deliver inside that price.

Live sports rights are skyrocketing, original content isn’t cheap, and the more value you promise upfront, the harder it becomes to raise prices later without losing subscribers. It also should be noted that ESPN+ doesn’t include anything broadcast on traditional ESPN channels, so the value you’re gettting there is relatively small.

“We’re giving NFL fans more opportunities than ever…”

The ESPN–NFL partnership has been another Iger talking point, with the promise of more NFL games than ever before, integration of NFL Network and RedZone, and a long-awaited direct-to-consumer ESPN launch. If everything lands perfectly, it could be a game-changer.

The reality is more complicated. The deal’s structure is still in motion, integration challenges are enormous, and ESPN will have to convert those extra games into meaningful revenue at a time when live sports streaming is still figuring out its long-term economics.

“Politics is bad for business… our job is not to advance an agenda.”

On the cultural front, Iger has tried to steer Disney away from political firestorms, insisting the company’s primary mission is to entertain. It’s a sentiment aimed at calming both shareholders and a large portion of the fan base that’s been vocal about “culture war” fatigue.

The issue? Disney’s storytelling—whether in Star Wars, Marvel, or animation—will always intersect with cultural conversations. While Disney has done a better job of staying out of politics as of late, the company still finds itself having to win back fans for past decisions.

So what can Disney cash right now?

Not all of Iger’s checks are destined to bounce. Disney Cruise Line is thriving, and the upcoming Disney Adventure in Singapore is already attracting huge buzz.

If the $29.99 streaming bundle delivers sustained engagement and ESPN’s NFL integration hits key milestones, Disney could have two strong wins in the near term. And if the studio can follow them up with a streak of box office hits, the “quality first” narrative could start to feel like reality.

But until those wins materialize, there’s a gap between the confidence in Iger’s words and the current challenges on the ground. The ambition is classic Disney—but ambition alone doesn’t keep the lights on.

Right now, the company has to prove that it can turn all those big promises into something fans, investors, and critics can actually see and feel.