A popular family streaming service has filed for Chapter 11 bankruptcy just months after finalizing a landmark acquisition.

The Age of Streaming

Streaming services have revolutionized the way consumers access and enjoy media content, offering a variety of platforms catering to different tastes and preferences.

Major players in the market include Netflix, Amazon Prime Video, Disney+, Hulu, and HBO Max, among others. Each service provides a mix of original content and licensed programming. Netflix, known for its vast library and high-quality original series like Stranger Things and The Crown, has long been a pioneer in the streaming space.

Amazon Prime Video offers a diverse range of content, including its acclaimed series The Marvelous Mrs. Maisel, and access to a vast library of movies and TV shows.

Disney+, leveraging its extensive catalog of content from Disney, Pixar, Marvel, Star Wars, and National Geographic, appeals to family audiences and fans of these franchises, and Hulu provides a mix of current TV shows, original content, and films, often catering to a more mature audience.

HBO Max boasts a wide variety of HBO series, Warner Bros. movies, and exclusive content like Game of Thrones and Friends.

Netflix: The King of Streaming

Netflix remains the most lucrative streaming service. Its subscription model, combined with a global reach and continuous investment in original content, has helped it maintain its position amid the streaming wars. Disney+, however, has rapidly gained ground, leveraging its strong brand and popular franchises to attract subscribers.

Netflix still has the most subscribers, but Amazon Prime Video and Disney+ continue to follow closely behind.

Disney+ achieved significant growth, reaching over 100 million subscribers within a few years of its launch in November 2019, though the service has yet to be as lucrative as Disney execs had hoped.

Remember Redbox?

Redbox was a popular movie rental service known for its convenient, self-service kiosks located in high-traffic areas such as grocery stores, pharmacies, and convenience stores.

Founded in 2002, Redbox revolutionized the traditional movie rental model by offering DVD, Blu-ray, and video game rentals through automated retail kiosks. Customers could browse available titles on the kiosk’s touchscreen, select a movie or game, and rent it for a low daily fee.

The business model provided a cost-effective alternative to subscription-based streaming services, especially for consumers who preferred physical media or didn’t have reliable internet access.

The service also offered digital rentals and purchases through its streaming platform, which allowed customers to rent or buy movies online. The service’s extensive network of kiosks and easy accessibility made it a go-to option for many movie enthusiasts looking for the latest releases and classic favorites without the commitment of a subscription.

Ultimately, however, Redbox couldn’t keep up with the changing of the times–and the dawn of the streaming era.

A Popular Streaming Service Bites the Digital Dust

Chicken Soup for the Soul Entertainment (CSSE), the streaming service that acquired Redbox in August of 2022 as part of a massive $375 million deal, has filed for Chapter 7 bankruptcy.

At the time of the acquisition, CSSE hoped that pre-pandemic numbers would return. Unfortunately, that did not happen. In less than two years, CSSE began to face extremely difficult times, amassing nearly $1 billion in debt against only about $400 million in assets. As times got harder, CSSE took out additional loans, which resulted in a choked cash flow.

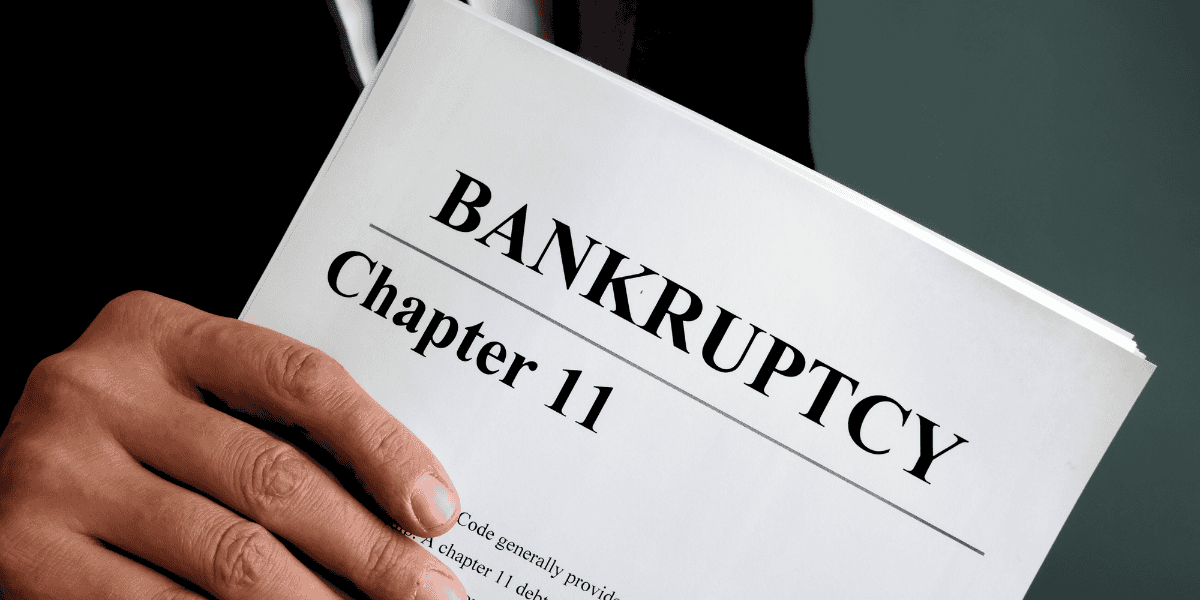

The company filed for Chapter 11 bankruptcy on June 29 in the state of Delaware. The filing revealed an extensive list of creditors, including Walmart, Walgreens, and Sony Pictures. The filing further showed that when CSSE acquired Redbox, it also acquired $325 million in the rental service’s debt.

Trouble, Trouble, and More Trouble

Days later, it was revealed that CSSE was almost seven days late in paying its employees, and employee health benefits were also suspended. Company stock sharply nosedived by almost 90% in the last 12 months, and once news of the entertainment company’s bankruptcy made the headlines, shares of CSSE were trading at just $0.12.

Earlier this week, CSSE revised its filing, opting for Chapter 7 instead of Chapter 11 bankruptcy. The change means that the company will liquidate its holdings rather than attempt to reorganize its debt.

When the filing was initially made, Redbox still operated nearly 30,000 kiosks across the U.S., but this week, CSSE announced the end of Redbox completely.

The closure of Redbox means that 1,000 employees will lose their jobs, but beyond that, it’s not clear how CSSE’s bankruptcy proceedings will go, and details about the entertainment company’s final outcome remain to be seen.