A major deal between two entertainment giants could potentially be sealed this weekend, though talks about the deal collapsed in April, May, and June.

An Independent Big Player in the Entertainment Industry

Skydance Media was founded in 2010 by David Ellison, the son of Oracle co-founder Larry Ellison, and has quickly risen to prominence as a major player in the entertainment industry in just 14 years.

Initially launched with a focus on film production, the company soon diversified its portfolio to include television, interactive media, and animation.

Ellison leveraged his industry connections and vision to secure a co-financing deal with Paramount Pictures from the beginning, and that partnership facilitated Skydance’s involvement in several high-profile projects and blockbuster films, including Mission: Impossible – Ghost Protocol (2011) and Star Trek Into Darkness (2013).

That involvement significantly boosted the company’s reputation and visibility in Hollywood.

As Skydance expanded, it ventured into television production, establishing Skydance Television in 2013, which produced acclaimed series such as Grace and Frankie and Altered Carbon, demonstrating the company’s ability to deliver high-quality content across different media platforms.

Then, in 2016, Skydance further diversified by launching Skydance Interactive, aimed at developing virtual reality and other interactive content, and Skydance Animation, a partnership with Spain’s Ilion Animation Studios, to produce animated films.

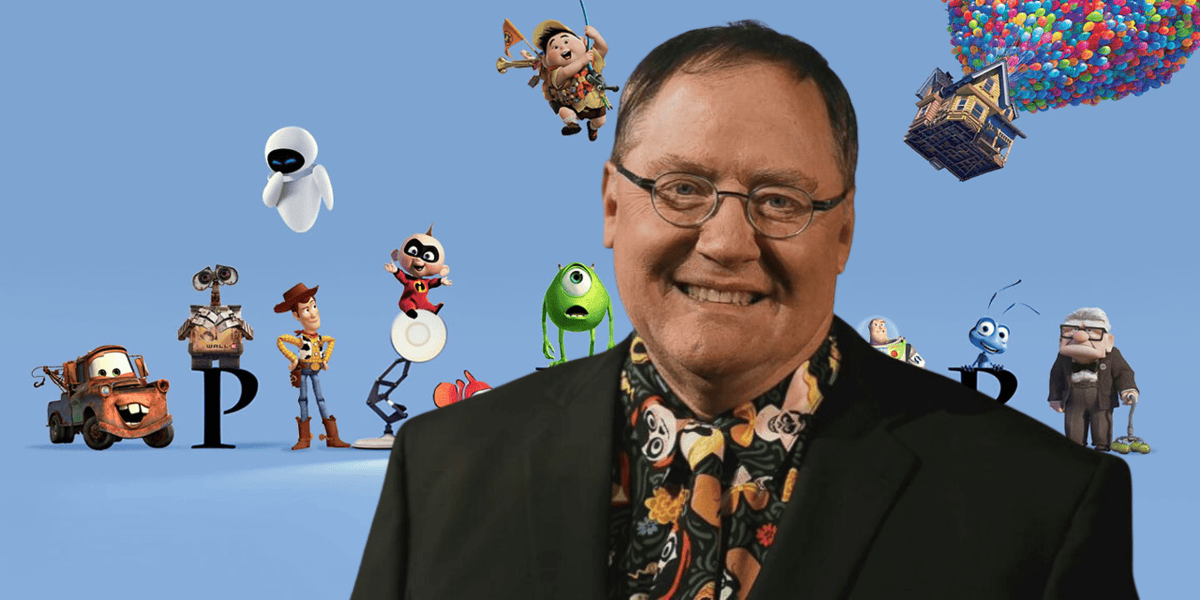

In January 2019, Skydance Animation hired former Walt Disney Animation Studios Head of Animation and Pixar Animation Studios Chief Creative Officer, John Lasseter, to lead the division after Lasseter stepped down at Pixar in response to claims from female employees at Pixar about inappropriate behavior on Lasseter’s part.

These strategic expansions have enabled Skydance Media to become a multifaceted entertainment powerhouse, continuously evolving to meet the demands of a dynamic and competitive industry.

Per the Skydance website:

Skydance’s independence, versatility and multi-platform approach have propelled the Company’s growth in live-action features, television, animation, interactive and new media. Today, more than 500 colleagues across two continents share David’s vision and, together, have expanded Skydance’s portfolio, creating a world-class studio on the forefront of where entertainment is heading.

Skydance and Paramount (Want to) Strike a Deal

Skydance and Paramount began exclusive talks in April 2024, but in May, those negotiations lapsed, and no agreement was made. The two entertainment giants continued their negotiations despite the emergence of other entities. In June, the two spent a “marathon weekend” in talks and seemed to be headed toward an agreement.

But as the special committee at Paramount was preparing to vote on the deal, attorneys for National Amusements, Paramount’s parent company, sent communication to the committee to cease talks, and the deal fell through yet again.

Despite those failed negotiations, however, recent changes to the potential agreement between the two entities could mean a handshake isn’t too far away.

Could Changes to the Previous Pact Be What Seals the Deal?

According to Variety, proposed changes to the potential deal didn’t result in a vastly different pact, as compared to previous proposals, though new verbiage does allow for a rise in Paramount stock.

The basic structure of the pact is the same: Skydance would buy out National Amusements Inc. and then combine Paramount and Skydance, with nonvoting Paramount Class B shareholders entitled to cash out nearly half their shares at $15/share.

Will They or Won’t They?

Though Reuters reports that the deal could be sealed this weekend–and that’s likely the hope of many of those with a vested interest in the deal–the OC Register reports that ” it’s still possible the deal could fall apart.”

Skydance Media has reached a preliminary agreement to purchase National Amusements, Inc., the parent company of Paramount Global, which owns and operates the CBS television network and MTV. The agreement would result in the merger of Skydance Media and Paramount Global.

The next step is for National Amusements to refer the deal to Paramount’s special committee once more so that the committee’s directors can review it.

The pact’s changes include stronger language to indemnify the company against legal action that could result from the merger. It also places a higher valuation on National Amusements, Paramount’s parent company.